Compare Medicare Supplement plans side by side

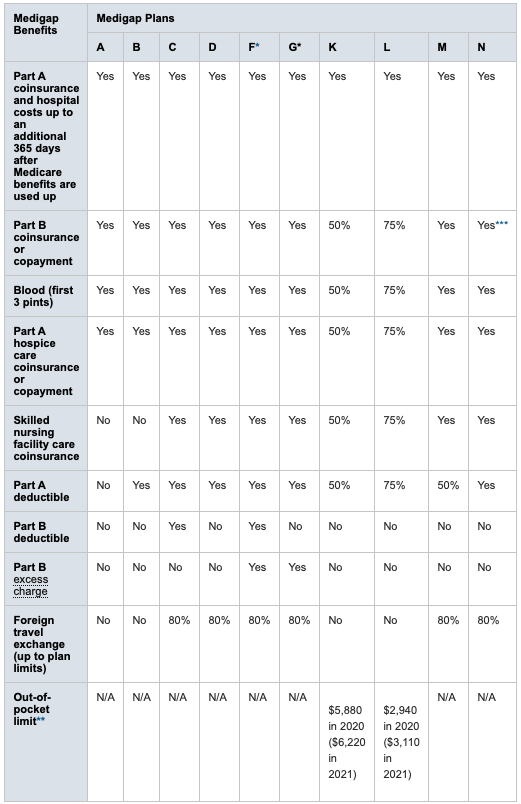

Medicare Supplement policies (also known as Medigap policies) are standardized and must follow federal and state laws designed to protect you. Insurance companies can only sell you a “standardized” policy identified in most states by letters (see the chart below).

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. As you can see in the comparison chart there are many options from which to choose. As licensed insurance agents we can help you understand the differences between the plans so that you can decide on the right plan for you.

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Did you know that each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer? Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Keep in mind, that the Medicare Supplement policy covers co-insurance after you’ve paid the deductible (unless the Medigap policy also pays the deductible).

Compare the Best Medicare Supplement Plans

* Plans F and G also offers a high-deductible plan in some states. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,370 in 2021 ($2,340 in 2020) before your Medigap plan pays anything. (Plans C and F aren’t available to people who were newly eligible for Medicare on or after January 1, 2020.)

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that don’t result in inpatient admission.

As of January 1, 2020, Medigap plans sold to new people with Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you’ll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

Source: www.medicare.gov

By contacting the phone number on this website you will be directed to a licensed agent.